Smart energy management for industrials

An ecosystem approach to reduce energy costs and achieve ESG goals

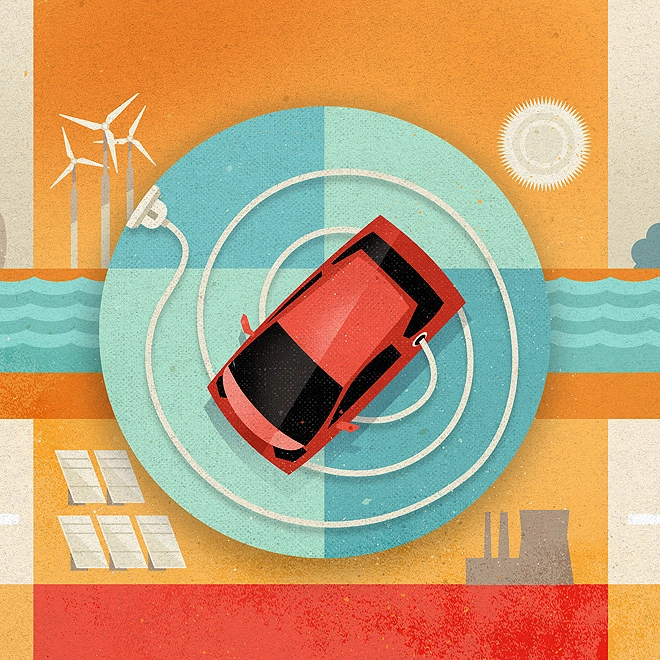

Converging trends will likely accelerate industrial companies’ adoption of energy management solutions and potentially boost their interaction with electric utilities and the grid.

Executive overview

Energy management is becoming a growing component of business strategy, with half of industrial companies surveyed in the Deloitte Resources 2020 Study reporting incorporating energy management at the corporate strategy level.1 Industrial companies are looking more closely at their energy profiles to identify opportunities for cost reduction, decarbonisation, and resilience. They are increasingly adopting energy management technologies and considering onsite resources, such as renewable energy and energy storage. Many are participating in current utility programmes to achieve energy management goals and some see further opportunities in the more interactive electric utility and market programmes that are developing.

For electricity providers, the opportunities involve potential revenue generation from the installation and maintenance of new services, such as solar power, energy storage and resiliency solutions, and potential value from customer-owned resources used for peak shaving, grid balancing, and deferring capital spending on grid infrastructure. This article highlights the following key elements:

- The opportunities that exist for industrial companies and electricity providers to benefit from adoption of energy management, clean energy technologies, and closer interaction with electric utilities and the electric grid

- The market forecast for the next decade, including which US regions will likely see greater growth in these offerings

- Implementation strategies, including examples of early case studies and some promising technologies entering the market

- The challenges that both sides are addressing as they increasingly work together on these solutions

Framing the opportunity for industrial companies

Three trends are converging in industrial businesses, creating an opportunity for greater grid interactivity of industrial assets (figure 1). The first is a broader move toward Industry 4.0, or digital transformation of manufacturing processes and products. Digital transformation and technologies, such as cloud, artificial intelligence (AI), and the internet of things (IoT), bring widespread connectivity for everything from machines in production lines, to heating and cooling systems, to office and factory lighting. This connectivity, in turn, allows for many of the assets inside a building to be managed, optimised, and maintained through data analytics and insights.2 Insights and heightened ability to manage assets can also lead to cost savings and a growing list of options for a cleaner, more flexible and resilient power supply.

The second trend is the electrification of industrial fleets, processes and space heating and cooling in buildings in line with the broader energy transition taking place across the economy.3 Electricity currently represents only about 11% of total industrial energy consumption, with natural gas and other fuels accounting for the rest.4 However, electricity use is gaining importance as industrial companies actively search for ways to further electrify their energy use as part of broader sustainability efforts. Citing pressure from investors, customers and employees, industrial leaders are interested in ways that electrification could support their environmental, social and corporate governance (ESG) goals, particularly as they relate to decarbonisation efforts.5

The third trend converging with digital transformation and electrification is energy management, which involves tracking and optimising energy use to achieve goals, such as saving costs, reducing carbon emissions, and increasing resilience. Always a part of the mix when considering energy management for industrial companies, resilience is now becoming a priority based on recent severe weather or climate events in the United States, including hurricanes, wildfires, and ice storms. Industrial leaders are increasingly concerned about maintaining uptime for their critical assets, and in the Deloitte 2021 Industrial Grid Interaction Survey (see the sidebar, “About the Deloitte 2021 Industrial Grid Interaction Survey”), manufacturing executives cited power outages due to weather-related incidents as the biggest threat to their current electricity supply.

About the Deloitte 2021 Industrial Grid Interaction Survey

To understand the outlook and perspectives of industrial companies and electricity providers on the growth potential for innovative energy management solutions, Deloitte fielded two surveys in March 2021: One to more than 70 industrial manufacturing executives and senior leaders, and another to more than 30 electric utility executives and senior leaders. The findings were supplemented by interviews with executives and leaders in utilities and energy management solution providers.

At the same time, industrial companies are eager to find ways to reduce energy costs. In the Deloitte 2020 Resources Study, 48% of industrial respondents identified the desire to cut costs as the primary driver of their decision to implement energy management programs. Additionally, 56% of respondents expected electricity rates to increase up to 5% in the two years following February 2020. The wallet is speaking loudly for improving energy management.

Distributed energy resources (DER), such as onsite solar power, wind power, and battery storage, are increasingly finding their way into industrial environments and can help commercial and industrial businesses achieve their energy management goals of saving costs, reducing carbon emissions, and increasing resilience. They range from the combined heat and power systems many industrials have operated for decades, to more recent installations of onsite solar or wind energy systems, battery storage, microgrids, building-level nanogrids, or electric vehicle (EV) chargers. The Smart Factory @ Wichita6 is an example of a greenfield manufacturing facility that takes advantage of DER (figure 2).

The costs of DER have fallen so sharply in recent years that these resources outcompete conventional energy resources in many regions, even without policy incentives. And incentives can cut payback time, making DER even more attractive. Also, new policies designed to enable DER participation in wholesale energy markets may further sweeten the pot in the future.

Incentives are offered at the federal and state level, as well as by utilities, often in the form of rebates funded through state initiatives (figure 3). In the Deloitte 2021 Industrial Grid Interaction Survey, 50% of manufacturing executive respondents believe the regulatory environment and government incentives will help drive adoption of renewable energy. State and regional policies can also help companies earn credits that have value in markets, such as the carbon credits traded through the Regional Greenhouse Gas Initiative, a coalition of 11 states in the Northeast that joined to form a carbon cap-and-trade system.7

Location matters: Understanding the opportunities through a geographic lens

Electricity capacity from DER, such as solar, battery storage, and EV chargers, in the United States is projected to rise to 387 gigawatts (GW) by 2025, from 316.4 GW in 2020, driven by US$110.3 billion in cumulative investment between 2020 and 2025.8 But that growth will likely spread unevenly across the country, largely due to differences in policy, regulatory and market structures from state to state. Five state policies that tend to encourage DER growth are renewable portfolio standards (RPS), net metering, energy efficiency resource standards (EERS), third-party solar power purchase agreement (PPA) policies, and energy storage incentives. Access to wholesale electricity markets and carbon-pricing systems can also make DER deployment more attractive, and DERs may generate more savings in states with higher electricity prices. Figure 4 illustrates states’ relative attractiveness for DER based on these factors.

Framing the opportunity for electric power providers

For electric power providers, the greatest opportunity may be increased electricity sales as industrial companies and other customers electrify more of their energy end uses. Providers may be traditional utilities or their unregulated subsidiaries, renewable energy developers, or others who can increasingly provide electric power through a variety of new technologies. Of the electric utility companies surveyed in the Deloitte 2021 Industrial Grid Interaction Survey, 68% said they had programmes to help customers further electrify fleets, buildings, and industrial processes.

Beyond potentially rising electricity sales, many power providers are already participating in growing markets for electric services, such as the planning, financing, installation and operations and maintenance of onsite generation, energy storage, electric vehicle chargers, microgrids/nanogrids, and more—often through a turnkey “as-a-service” business model. Two-thirds or more of the utility companies surveyed in the Industrial Grid Interaction survey saw future revenue opportunities associated with providing each of these services.9

For traditional electric utilities, the growth of these services may reduce electricity sales, as customers increasingly self-generate or implement energy efficiency measures. However, these services can also provide benefits for the grid and utility resource planning. For example, as more customers add DER and link their energy usage to increasingly sophisticated energy management systems, the utility or grid operator can tap those resources to meet peak demand or unusual spikes in electricity usage. Operators can also harness this new flexibility to help balance electricity supply and demand as the share of large-scale solar and wind power, which can be intermittent, grows. In fact, 84% of the Deloitte 2021 Industrial Grid Interaction Survey respondents said optimally located DER can be a flexible resource to help balance the grid, especially as more intermittent renewables are added.

In the longer term, these new local sources of incremental electricity output mean utility planners can sometimes defer capital spending on generation, transmission, and distribution infrastructure. More than half of the Industrial Grid Interaction survey respondents said DER can help their company reduce capital spending on grid infrastructure, such as new generation or transmission. Finally, some traditional electric power providers see the expanding market for energy services as an opportunity to differentiate themselves, and 52% of respondents said their company could gain a competitive advantage as they compete with new market entrants in this area, usually through an unregulated subsidiary.

Outlook for deployment: The industrial smart energy management revolution and the role of DERs

In many industrial settings, building management systems (BMS) were traditionally focused on high-traffic areas and were geared toward optimising the performance of the HVAC systems. However, with the rise of Industry 4.0 inside manufacturing environments, sensors, IoT and cloud analytics can move toward “smart” energy management that encompasses heating and cooling of all spaces including warehouses and the production floor, but also industrial equipment, pumps, generators, and even vehicles and lighting. The 2020 Deloitte and Manufacturers Alliance for Productivity and Innovation Smart Manufacturing Ecosystems Study identified that 80% of manufacturers surveyed are investing in plant consumption and energy management use cases for the smart factory.10

The goal of such a use case is to leverage contextual data to optimise energy use and reduce overhead costs, enabling efficiencies, such as auto-idling of assets that aren’t being utilised. In addition, smart energy management systems could hold the key to unlocking the potential of greater grid interactivity for industrial companies.

A smart energy management system is a computer-based system designed to monitor, control, measure, and optimise energy consumption in a building, factory, or any facility. The systems can connect electricity-consuming systems, such as HVAC, lighting, and manufacturing equipment, with meters, sensors, and other devices that can track, measure, and aggregate the data internally and potentially communicate with the utility or grid operator to time interactions, such as energy purchases during cheaper, off-peak hours; participation in demand-response events; EV managed charging programs; and transmission of surplus energy as part of other utility or grid operator programs.

The following are some of the types of solutions industrial companies can deploy to help reduce energy costs, meet ESG goals, and boost resiliency from weather-related outages. To understand how some of these examples could be applied to a hypothetical industrial company, see the infographic.

Flexible load programs

One of the first types of energy management solutions that companies often implement is flexible load programmes, typically offered by utilities or regional grid operators. A common type of programme is demand response, in which the utility or grid operator pays businesses to reduce energy use when supply is needed.11

These programmes are often simple to participate in and require little, if any, investment. Once the facility receives a signal for a demand-response event, they can either respond manually or automatically through their smart energy management or other software systems (see the sidebar, “Flexible load programmes in action: Demand response”). They typically receive payments for being on standby for events and are also paid based on how much they reduced energy use during each event.

Flexible load programmes in action: Demand response

Flexible load programmes are an increasingly critical resource to help grid operators balance the intermittency from rising volumes of utility-scale solar and wind plants. And sophisticated software programmes are helping grid operators synchronise and fine-tune these interactions to benefit customers and the grid.

Utilities may be able to defer capital expenditures on new infrastructure by harnessing flexible load as well as output from other customer-owned DER. According to one report, deferred or avoided investment due to load flexibility could potentially exceed US$15 billion per year by 2030.12 State utility commissions are increasingly requiring regulated utilities to pursue such resources.

Onsite renewable generation with battery storage

Onsite renewable generation includes power generation systems located on the company’s campus that are sourced from renewables, such as solar panels, wind turbines, and biomass. Onsite systems may be owned and operated by the company itself or by a third party, often through a PPA. Solar and other onsite resources may receive bill credits for surplus output they provide to the grid, usually through utility net metering programmes.

Battery storage systems may be deployed separately, usually to draw and store electricity from the grid during cheaper, off peak hours for use during more expensive, peak hours or to shave consumption throughout the day to avoid volume-based “demand” charges. Battery storage is also increasingly deployed with solar and other generation systems to save surplus output for use during lower output periods (see the sidebar, “Onsite renewables-plus-storage in action: Solar-plus-storage and smart management system”). In the Deloitte 2021 Industrial Grid Interaction Survey, 41% of manufacturing respondents stated that if they add any onsite generation, it will include storage. Battery pack costs have plunged nearly 90% in the last decade and they continue to fall,13 and thus, this trend will likely strengthen.

Onsite renewables-plus-storage in action: Solar-plus-storage and smart management system

EVs and EV chargers

EVs and EV chargers are becoming increasingly common as organisations electrify fleets. For industrial companies with warehouses, production facilities, field sales, and aftermarket services, the variety of vehicles can range from forklifts to service trucks. EV charging can be modulated and optimised for when prices are lowest or supplies are “greenest,”14 or in some cases, when compensation is available for providing grid services. This is called V1G or managed charging. The EV batteries can also act as a storage resource that can discharge energy from the vehicle to the grid (V2G) or a local microgrid, though technical, business, engineering and safety issues must be further addressed before V2G is practiced widely in the United States.

Many utilities offer incentives for customers to electrify their internal and external fleets. These incentives are often in the form of rebates on EV charging equipment or upgrading local grid components at reduced or no charge to build out the “make-readies” for new EV charging stations.

Microgrids

A microgrid is a local group of energy resources, such as those described above, controlled by software that synchronises and manages the resources to meet the goals of the organisation that owns or leases the microgrid.15 Microgrids are usually connected to the traditional power grid, and may be able to disconnect or “island” from the larger grid to serve the customer during an outage or peak-price period. Among the potential benefits of a microgrid are that it can power the facility when the centralised grid is offline. Controls that provide this resilience may boost system cost, but may be worth it compared to the cost of an extended outage.

Tad Glauthier, vice president of Market Development for energy storage solution provider Stem, Inc., said, “The ability to island and retain power during an outage used to add 50% to the cost of a microgrid system, but providers have productised this feature, so the premium is now closer to 20–30% and continues to fall.”

Another potential microgrid benefit is the ability to cut costs because they can optimise for price and switch to local generation sources when utility power prices rise.16 Microgrids, which increasingly include renewable generation and energy storage, can also optimise for the “greenest” mix of resources to help meet company ESG goals or comply with mandates. Finally, microgrids can participate in utility, grid, or market programs for additional savings and potential revenue streams, as described below.

Utilities are increasingly helping communities develop local microgrids as a cost-effective solution to boost resiliency and potentially provide additional power during peak usage periods.

Opportunities on the horizon

Reaping further value from DER

A growing opportunity that may help reduce the payback time for industrials’ investments in DER is combining them with other DER to bid into wholesale electricity markets. This is typically managed through “aggregators” and does not require in-house expertise. Most DER do not produce enough energy to bid into US regional wholesale electricity markets alone, but together they may qualify. A federal energy ruling that is currently being implemented (FERC Order 2222) mandates that the six federally regulated wholesale electricity markets create market rules enabling these interactions. Hurdles must be overcome before DERs can be smoothly integrated into markets and it may take time.17 But once they are, aggregated groups of DER can be compensated for providing energy and grid services in wholesale markets.

DER aggregators in California, New York, Texas, and a few other states have been aggregating DER and bidding them into markets on a limited basis, but programs will need to be revised and expanded to bring larger-scale participation. Regulatory, legal, technical and market structure hurdles must still be overcome.18

Peer-to-peer electricity trading

While aggregated DER participation in wholesale markets may be on the near horizon, an opportunity likely to arise in the slightly more distant future is peer-to-peer (P2P) trading of electricity. Such systems are being piloted in select locations in the United States and globally and would enable DER owners to trade electricity with each other, usually through a platform enabled by technologies such as blockchain. The challenges to realising P2P electricity trading are similar to those for wholesale market participation, though generally even more difficult.

Maneuvering around potential speedbumps

As industrial companies consider new opportunities to interact with the grid, and electricity providers consider the value of the growing wave of grid-connected assets, there are a few challenges that may need to be addressed, including:

Having (or gaining) awareness of the current state

As the management expert Peter Drucker is often quoted, “You can’t manage what you can’t measure.”19 Some industrial companies may lack a solid picture of the current state of their electricity consumption, which is a critical first step.

Coordinating a comprehensive, informed energy strategy

Harnessing opportunities to manage and optimise energy usage and assets may not be a core competency for industrial companies. In addition, their efforts, knowledge, and projects may be siloed, preventing them from realising the full benefits of programmes.

Navigating the regulatory environment

State regulatory structures may not incentivise regulated utilities to develop new services.20 However, many utility parent companies have unregulated subsidiaries that can compete and pursue opportunities in this space. Utility respondents in the Deloitte 2021 Industrial Grid Interaction Survey rated regulatory hurdles as the biggest challenge to market participation for customer-owned DERs (26%).

Some industrial companies may lack a solid picture of the current state of their electricity consumption, which is a critical first step.

Managing cyber risk

The US electric power grid faces millions of hacking attempts every day.21 As more DER and devices are connected to the grid and controlled digitally, the potential cyberattack surface expands and opportunities for bad actors to enter utility and grid networks multiply.

It’s critical that utilities and industrial customers deploying DER address cyber risks upfront and throughout the deployment to effectively identify, manage and navigate those risks. Viewing cyber risk management as part of the transformation and not an obstacle can better enable utilities and their customers and partners to effectively manage and mitigate those risks. Utilities should consider identifying risks through specific steps, such as third-party assessments, and mitigating risks in areas such as application security, security and control design, security monitoring, and incident response and resiliency.

The path forward

Start with a smart energy management plan

Industrial companies can start by assessing their energy use through examining historical consumption, costs, emissions, and other data, and establishing a baseline from which to improve performance. Next, they can define their vision and mission and set targets. Performing a cost-benefit analysis can help inform decisions about how to fund the programme and could include exploring available incentives, market opportunities, and other options. Consulting an experienced energy service provider may be helpful.

Participate in the ecosystem

Given the potential complexities of implementing a suite of energy management solutions, industrial companies may benefit from bringing multiple ecosystem players together. For example, 70% of manufacturing respondents indicated their utility is a key ally. They can also form alliances with technology platform providers, equipment suppliers, renewable energy developers, traders, and others to orchestrate holistic solutions.

From a utility point of view, when asked which ecosystem players they are collaborating with to offer energy management solutions, survey respondents most frequently selected battery storage providers (figure 5). Other participants might include electricity component suppliers, engineers and financial service providers.

Is energy-as-a-service an answer?

While the case for energy management investments is getting strong, some companies may hesitate to make large capital investments. But they may still be able to harness these opportunities to save costs, and meet ESG and other goals. Half the manufacturers surveyed said a 2–3-three year breakeven on capital investments was their most important financial condition.22 While the payback periods on energy management investments are falling rapidly and rising opportunities for grid interactions will likely reduce them further, a simpler pathway for industrial companies is developing.

Energy-as-a-service (EaaS) is a turnkey delivery model that may combine installation, ownership and operations and maintenance of onsite renewables, storage, and other DER (figure 6). These services may also be packaged with financing, REC or carbon credit trading, and participation in available utility or wholesale market programs to optimise returns.23 All for one monthly subscription fee that may be significantly lower than the company’s current monthly electricity costs.

Final thoughts

Converging trends will likely accelerate industrial companies’ adoption of energy management solutions and potentially boost their interaction with electric utilities and the grid. The drive to reduce energy costs and achieve ESG goals will be paramount. Resilience from outages is another key driver. Rapidly falling costs of technologies such as solar, wind and battery storage will also likely play a role, as will favorable government incentives and growing awareness among industrials. Industry 4.0 can also provide new opportunities for improved energy management and cost savings. And emerging opportunities for DER interaction with electricity providers and markets can create new revenue streams and reduce payback time for these investments. Finally, the expanding ecosystem of providers offering simplified, no-money down EaaS solutions can reduce industrial companies’ concerns over lack of energy expertise or capital. When it comes to energy management, these accelerating trends may spur industrial companies to get increasingly smart, connected and interactive.

Power and Utilities

Industrial companies are increasingly developing energy strategies to save costs, meet decarbonisation and other ESG goals, comply with regulatory mandates, and boost security and resiliency. Deloitte can assist clients in electrifying operations and buildings, integrating operations with electricity providers, and examining energy efficiency improvements along with potential energy intensity reductions. Deloitte’s energy management services for industrials include strategy and planning; renewable and distributed energy resource solutions; carbon trading and risk management; cyber risk; tax and accounting strategy, advice, and implementation; and governance and controls (including assurance around decarbonisation goals).