Live sports: The next arena for the streaming wars

As streamers take a growing share of a thriving market, can they go the distance?

From football (soccer) to cricket to baseball to golf, streaming video providers around the world are spending billions of dollars on live sports rights in a bid to attract, retain, and monetize an increasingly fickle audience. Deloitte Global predicts that in 2023, streamers will spend over US$6 billion on exclusive major sports rights in the largest global markets.1 To put that into perspective, in 2021, the combined content spend by all streaming providers was about US$50 billion.2 Streamers’ spending on sports rights is a relatively small, but significant, proportion of that total. The growth in expenditures on live sports content underscores the increasing interdependence between streaming providers and the largest sports leagues.

The rules are changing for streaming providers and sports organizations

Streaming services are the latest to enter the live sports ring, with cable, broadcast, and satellite services all contending for fans. In one corner stand entertainment companies and regional sports networks with traditional linear channels that also offer a streaming service.3 In another corner are the “pure play” streaming providers who have only their streaming service as an option to reach consumers. In the third corner, there are tech companies looking to broaden the reach of their streaming services and increase time spent within their ecosystem. Finally, leagues and individual teams are launching specialized streaming services to establish direct connections and serve super-fans.4

Two recent examples highlight the enterprising approaches that streaming providers are taking. In a unique global deal, Apple has committed to spend at least US$2.5 billion for the sole rights to stream every US Major League Soccer (MLS) game over the next 10 years via a dedicated Apple TV app.5 MLS season ticket holders will be able to access the app for free, but everyone else will need to pay for this content (some games will be available for free to Apple TV+ subscribers). Meanwhile, Viacom18 successfully acquired domestic digital rights to the Indian Premier League’s (IPL) cricket games in a five-year, US$3 billion deal.6 Disney, which previously won both the digital and linear broadcast rights, will pay IPL US$3 billion over the same period to retain the broadcast rights. Disney also recently won digital and linear broadcast rights in India for International Cricket Council events through 2027.7

Both streaming providers and sports organizations have much to gain from their growing symbiosis. Facing greater competition and more subscriber churn, many streaming providers are using live sports as a differentiator to help attract and retain subscribers. Providers also want to use live sporting events to entice advertisers, who see their sizable audiences as a smart investment.9 Sports organizations, on their end, want to monetize their rights further, expand access to products, and pursue younger consumers.

Premium sports competitions such as the Premier League, IPL, National Football League (NFL), and National Basketball Association (NBA), depend on media rights as a major source of revenue (along with ticket sales, sponsorships, and merchandise) and see streaming providers adding to that revenue.10 For smaller and newer sports and leagues, streaming services may offer the benefit of coverage for the first time as a pathway to greater awareness and further growth.11 Streaming providers can also help grow the global audience for a sport, giving viewers in different countries easier access to sports they might not be as familiar with.

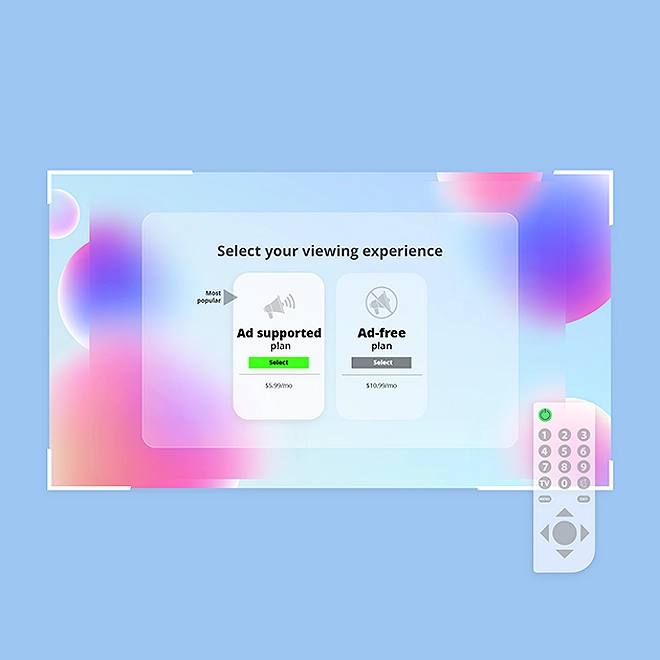

The good news is that fans may get access to even more content related to their favorite sports (e.g., original shows and documentaries, historical games, associated secondary competitions, etc.). Streaming services could also provide new innovations around personalization, interactivity, and real-time data analysis. In the near future, we should see more experimentation from streaming providers looking to offer more tailored experiences. There have already been some initial forays into integrating sports betting by FuboTV, and Amazon is planning on offering multiple feeds for their NFL games in the US market, allowing fans to choose their viewing experience.12

That said, the fragmentation of rights across even more platforms could make it more difficult for fans to access what they want to watch when they want to watch it—not to mention create added cost and complexity. Many fans already have to maintain subscriptions to one or more pay TV providers and multiple streaming services to watch their favorite team or sport. This could lead to increasingly frustrated and burdened fans who may miss out on the content they love.13 Sports leagues and streamers should ensure that they aren’t creating artificial barriers to fan engagement.

Another challenge is that high-quality live sports is technically harder to stream than broadcast. Sports content tends to be fast-paced, necessitating a higher frame rate than other genres.14 Sports fans also demand high picture quality and superb reliability, particularly with premium-priced subscriptions. Additionally, sporting events are more sensitive to latency issues—delays in the delivery of content—and with streaming, those delays can extend for as long as a minute.15 Looking ahead, streaming won’t be able to deliver experiences such as in-game betting and interactivity unless the issues with latency are resolved.

The complete transition of live sports entertainment to streaming won’t happen overnight, if ever. Traditional broadcasters will likely remain by far the main buyer of major sports rights for quite some time, albeit with a smaller share. One reason for this is the tenure of sports rights: Depending on the geography and sport, contracts range from three to 10 years. This means that for some major sports, such as the NFL, the next opportunity for streaming providers to bid for rights and grow their share will not be till the early 2030s. Another is that rights holders may not want to risk a critical revenue stream when current linear broadcasts are already high-quality, low-latency, and have significant preexisting production and distribution infrastructure already in place. It is also worth noting that free-to-air sports broadcasts have, historically, been critical to growing overall awareness of sports and creating new fans.

The bottom line

It will take a couple of rights cycles before the future of watching live sports becomes clear. The next big indicator could be when the NBA announces new deals for the US market starting in 2025.16 For sports streaming to go the distance, sports organizations and entertainment companies should consider several key things:

- Put the fan first. Skillfully use first-party data to understand fans’ needs and preferences and deliver the right amount of quality content, easy access, an engaging user experience, and exclusive perks, all at a reasonable cost.

- Expand the streaming service’s influence. Consider integrating it with social media, sports betting, gaming, fantasy sports, and other digital engagement channels.

- Improve streaming’s technical aspects. Enhance broadcast quality (for instance, by eventually moving from 4K to 8K resolution), reduce latency, and eliminate service interruptions.

It is important for both streaming providers and sports organizations to reflect on balancing their short- and long-term needs. Pure-play streaming providers and tech companies should consider if the high cost of live sports rights is worth it. Will it help attract and retain subscribers? Will it drive a halo effect for their other products and services? Traditional entertainment companies with both linear channels and streaming services should decide which service to prioritize when it comes to investment. And sports organizations should ask if their media deals are both meeting their current fans’ needs and cultivating the next generation of fans. Finding astute answers to critical questions like these will be key to what separates the champions from the runners-up.

Telecommunications, Media & Entertainment

Deloitte’s Global Telecommunications, Media & Entertainment practice focuses on helping companies thrive in the sector’s continually evolving business landscape. Our breadth of knowledge can help organizations uncover opportunities and understand trends that can spark new growth.

Learn More