Economic outlook & predictions from Europe’s CFOs

Still on the up – but with new challenges

European CFO Survey: Autumn 2021

As 2021 draws to a close, and with the number of COVID-19 cases still high, how do Europe’s CFOs see the prospects for the economy and their businesses in the year ahead? What are their intentions for capital spending and hiring? How concerned are they about supply shortages and rising inflation?

CFOs across Europe share their views in the fourteenth edition of Deloitte’s twice-yearly European CFO Survey. They largely retain the positive outlook they had in the spring though the level of optimism has softened a little and varies greatly between sectors. Confidence is weaker outside the euro zone, especially in the UK.

Overall, however, CFOs see an economy that is continuing to grow as the influence of COVID-19 wanes. They plan to increase their capital spending and hiring. But supply chain problems, a shortage of skilled labour and the fast rise in inflation worry them.

Business sentiment in Europe: financial outlook for 2021

- Economic activity has strengthened further, with service sectors bouncing back as COVID-19 lockdowns ease. CFOs are confident about the financial prospects for their company though slightly less so than in the spring.

- Multiple supply-chain problems have emerged, such as material shortages and delays in shipping and deliveries, and this has also contributed to a marked increase in inflation. The slight weakening in confidence across Europe is far more severe among CFOs in the UK, where supply problems are exacerbated by Brexit.

- Sectorally, too, confidence varies considerably. Automotive is bedevilled by particularly severe supply problems while CFOs in tourism & travel, opening up again after lockdowns, are the most optimistic among all sectors.

Investing, hiring – expanding

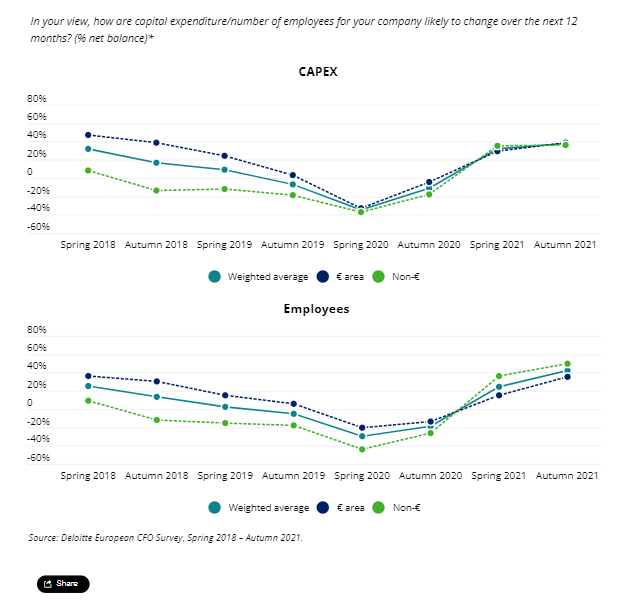

- Notwithstanding their worries about supply and inflation, CFOs reported that they increased their capital expenditure plans in the autumn compared to the spring.

- Their hiring intentions rose, too, and by a greater extent. The net balance of CFOs planning to increase their workforce rose to 42 per cent, from 24 per cent in the spring. This represents an all-time high since the series began in 2015.

- The strategic priority for CFOs is further expansion. They are concentrating on organic growth, probably to win back or gain market share in the post-pandemic world. Digitalisation, too, is a priority for them.

Inflation on the up

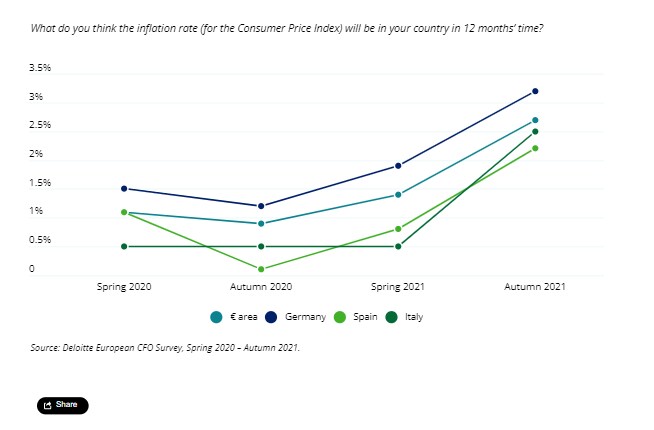

- As energy prices soar and supply chains struggle, CFOs’ expectations for inflation have surged in all countries surveyed. The expected average inflation rate in 12 months’ time for the euro area has almost doubled, from 1.4 per cent in the spring survey to 2.7 per cent now.

Conclusion: demand optimism, supply concerns

After a traumatic 18 months, economic prospects continue to look up, with COVID-19 less of an obstacle. Demand for goods and services is surging and Europe’s CFOs are generally confident and hastening to invest and hire.

But along with the surge in demand has come a less welcome surge in supply-chain problems and inflation. These and labour shortages are hindering CFOs’ efforts to respond to the economic recovery and adding to costs, so that expectations for operating margins are declining.

How the supply-side problems and inflation unfold in 2022 are a big uncertainty for the future. But for the time being CFOs are confident about demand and revenues, and their strategic orientation remains expansionary.

Read the full report to understand the economic prospects for Europe through the eyes of leading CFOs.

About the European CFO Survey

Since 2015 Deloitte has conducted the European CFO survey, giving voice twice a year to senior financial executives from across Europe. The data for the Autumn 2021 edition were collected in September 2021 and garnered responses from 1,330 CFOs in 17 countries and across a wide range of industries.