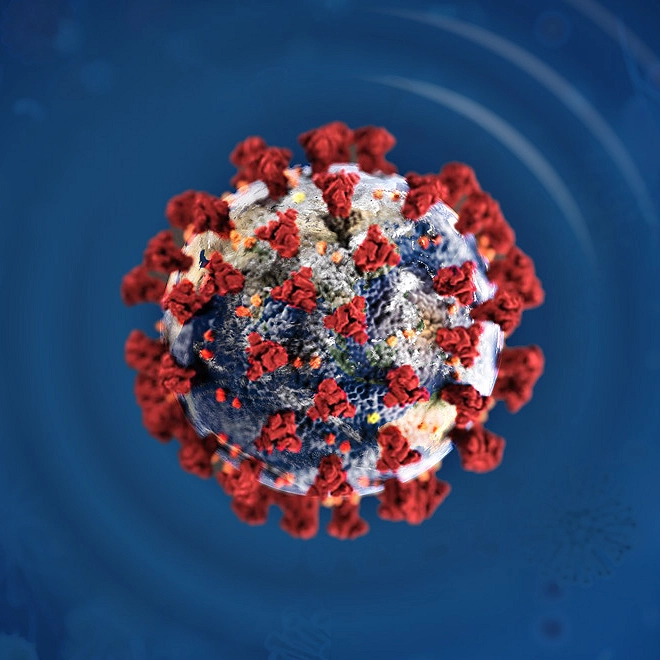

COVID-19 potential implications for the banking and capital markets sector

Maintaining business and operational resilience

Learn what questions banking and capital markets leaders should be asking themselves right now and what action steps they should consider in the face of COVID-19.

COVID-19’S impact on individuals, communities, and organizations is rapidly evolving. A recent Deloitte Insights article posited four different scenarios for the global economy resulting from COVID-19, which ranged from a mild and temporary hit to the worst-case scenario, a global financial crisis.1 Unfortunately, COVID-19 arrived when the global economy was already showing signs of a slowdown.2

In addition to the effects on the supply and demand side, COVID-19 has already jolted financial markets. Since February 21, 2020, bond yields, oil, and equity prices have sharply fallen, and trillions of dollars, across almost all asset classes, have sought safety. In the United States, 10-year bond yields have tumbled below 0.5 percent3 (figure 1), and equity prices on major stock indices around the world have fallen. It appears, as of now, that the markets are trying to price using the worst-case scenario, which has increased volatility recently (figure 2).

Learn more

Learn more about connecting for a resilient world

Read COVID-19 and the investment management industry

Read Potential implications of COVID-19 for the insurance sector

Learn about Deloitte’s services

Go straight to smart. Get the Deloitte Insights app

With ongoing shocks to the supply and demand side, there is potential for further market disruption. Institutions and individuals may be experiencing liquidity stress, including limited access to credit. This might, in turn, increase the probability of default, especially near or in the speculative grade of corporate debt. Private debt, including corporate and household debt, has reached record levels recently, and approximately one-half of the investment-grade market currently holds a triple-B rating.4

Central banks around the world, meanwhile, have already proactively intervened to calm markets and show commitment to using all possible measures. In its first emergency move since the recession in 2008, the US Federal Reserve (the Fed) recently cut the federal funds rate by 50 basis points.5 The Fed has also actively intervened in the repo market to add further liquidity.6 The Bank of Japan (BoJ), meanwhile, issued an emergency statement signaling that it would inject liquidity into the market by increasing asset purchases.7 The People’s Bank of China (PBoC) has also pumped more than US$240 billion of liquidity into the financial system as a countermeasure to the virus.8 Additionally, the Bank of England and the European Central Bank (ECB) have announced various plans to counter COVID-19 in the coming days.9

But as the situation develops, more action may be required by central banks, regulators, and governments, which would necessitate quick coordination at the national and international levels.

Meanwhile, banking and capital markets firms around the world are mobilizing and taking steps to minimize COVID-19’s effects on day-to-day operations. Firms are testing and implementing business continuity/contingency plans, which include alternate workplace arrangements such as split work sites, working from home, and rotating shifts for all types of employees, even traders.10 Many have also instituted universal travel bans beyond the countries experiencing the most severe effects, and have canceled large events. Institutions have also heightened measures to ensure the safety and health of their employees through various means. Banks have also requested that regulators ease capital requirements.11 Some regulators, such as the US Securities and Exchange Commission (SEC), have proactively granted relief for regulatory financial reporting to companies affected by COVID-19.12

Many banks are also acting as responsible citizens by extending loans to hard-hit borrowers, renegotiating credit terms, and even donating face masks to their clients.13

Beyond the operational actions already underway, banks and capital markets must remain hypervigilant. They need to also actively consider the short- and medium-term financial, risk, and regulatory compliance implications that are resulting from the continuing uncertainty around COVID-19.

This article explores these implications. It also raises questions around key areas that banking and capital markets leaders should be asking themselves right now and provides action steps for them to consider.

Of course, any actions taken will depend on the specific context of the organization and its unique circumstances regarding exposure to the virus. Also, organizational priorities may change dramatically depending on how the situation develops.

We do not know the long-term implications of COVID-19 for financial markets and banking and capital markets firms. But when normalcy returns, banks and capital markets firms will likely have learned a few lessons. These may include how to best retain operational resilience when confronted with future pandemics, and possibly how to design new operating models such as alternate work arrangements. COVID-19 may further accelerate migration to digital channels and connectivity.

Specific implications for banking and capital markets firms

Operational resilience |

|||

| Topic/issue | Current and potential developments | Relevant questions | Actions banks and capital markets firms should consider |

| Branch/ATM operations |

|

|

|

| Trade compliance |

|

|

|

Sources: Rachel Louise Ensign, Liz Hoffman, and Justin Baer, “Wall Street scrambles to harden virus defenses,” Wall Street Journal, March 1, 2020; Pete Schroeder and Michelle Price, “Wall Street regulator paves way for home trading as coronavirus spreads,” Reuters, March 9, 2020; Laura Noonan, Nicholas Mcgaw, and Primrose Riordan, “Banks seek trading rule guidance as coronavirus spreads,” Financial Times, March 6, 2020.

Financial and business impacts |

|||

| Topic/issue | Current and potential developments | Relevant questions | Actions banks and capital markets firms should consider |

| Liquidity management |

|

|

|

| Capital management |

|

|

|

| Revenue and cost management |

|

|

|

| Loan book, covenants, and exception management |

|

|

|

| Trading/hedging strategies |

|

|

|

Sources: Federal Reserve Bank of St. Louis, “Overnight repurchase agreements: Treasury Securities purchased by the Federal Reserve in the temporary open market operations,” accessed March 9, 2020; European Central Bank, “Statement by the president of the ECB,” March 2, 2020; John Ainger and Anooja Debnath, “Investors dodging market meltdown say they can’t find liquidity,” Bloomberg, March 9, 2020; Sohini Chowdhury and Cristian deRitis, “Beyond theory: A practical guide to using economic forecasts for CECL estimates,” Moody’s Analytics, August 2018; Laurent Birade, “CECL: Credit cards and lifetime estimation—a reasonable approach,” Moody’s Analytics, September 2018; David Enrich, James B. Stewart, and Matt Phillips, “Spiraling virus fears are causing financial carnage,” New York Times, March 6, 2020.

Risk and controls |

|||

| Topic/issue | Current and potential developments | Relevant questions | Actions banks and capital markets firms should consider |

| Market risk |

|

|

|

| Counterparty credit risk |

|

|

|

| Nonfinancial risks |

|

|

|

| Risk governance |

|

|

|

| Dividends and stock buybacks |

|

|

|

| Credit ratings |

|

|

|

| LIBOR transition |

|

|

|

Sources: Laura Noonan, Nicholas Mcgaw, and Primrose Riordan, “Banks seek trading rule guidance as coronavirus spreads,” Financial Times, March 6, 2020; Alexandra Dimitrijevic and Paul F. Gruenwald, “Coronavirus casts shadow over credit outlook,” S&P Global Ratings, February 11, 2020; Sinead Cruise and Lawrence White, “The end of Libor: the biggest banking challenge you've never heard of,” Reuters, October 8, 2019.

General implications for banks and capital markets firms

Operational resilience |

|||

| Topic/issue | Current and potential developments | Relevant questions | Actions banks and capital markets firms should consider |

| COVID-19 crisis readiness |

|

|

|

| Communications |

|

|

|

| Monitoring and review |

|

|

|

| Flex and remote work |

|

|

|

| Infrastructure/capacity |

|

|

|

| Quality of work/productivity and employee well-being |

|

|

|

| Offshore delivery centers |

|

|

|

| Global operations |

|

|

|

| Digital/IT infrastructure |

|

|

|

| Legal matters |

|

|

|

| Tax, financial, and regulatory compliance reporting |

|

|

|

The Deloitte Center for Financial Services

The Deloitte Center for Financial Services, which supports the organization's US Financial Services practice, provides insight and research to assist senior-level decision makers within banks, capital markets firms, investment managers, insurance carriers, and real estate organizations. The Center is staffed by a group of professionals with a wide array of in-depth industry experiences as well as cutting-edge research and analytical skills. Through our research, roundtables, and other forms of engagement, we seek to be a trusted source for relevant, timely, and reliable insights. Read recent publications and learn more about the center on Deloitte.com. For weekly actionable insights on key issues for the financial services industry, check out the Deloitte Center for Financial Services' QuickLook Blog.